Powering Home Buyers Savings On Your Mortgage

Orry Pounders is a professional Senior Mortgage Advisor for NEXA Mortgage, a top independent mortgage broker company in the nation. Orry works on the borrower’s behalf to find the best rate and loan from various institutions and focuses on building lifelong professional relationships. Your scenario is unique to your needs.

Mortgage Designed To Fit Your Needs

Personalized mortgage solutions to help you meet your goals

More Than Just A Mortgage

Customized For Your Needs

We are able to fully customize your mortgage program. Whether you want a particular number of years to payoff your home, or if you want a particular interest rate.

Learn To Build Wealth

Learn how to use your home like a savings account, save hundreds of thousands of dollars in interest, and strategize to build wealth through home ownership.

Plan Your Families Future

A goal without a plan is just a dream. Creating a plan to build a legacy for your children and teaching them the same will create generational wealth for your family.

I'd Like To Introduce Myself

My name is Orry and I was born and raised in Las Vegas. I take great pride in being a professional Mortgage Loan Advisor / Originator and helping you get your home loan approved.

My approach is to work with each client from an advisor’s perspective for your mortgage needs. We work together to provide family stability, earn wealth, reduce tax liability, and create a long term asset that you can borrow against if needed. I take great pride in being able to help you make the decision that best fits your family goals and add value to your experience. My goal is to help you achieve your homeownership goals, as well as educate you in regard to the financial benefits of owning a home. I look forward to providing personal service that you just cannot get from working with a big corporation when getting your mortgage approved.

Orry Pounders, MBA, NMLS #2013035

I’ve been involved in the real estate sector since 2005, when I first became a mortgage lender in Las Vegas mortgage originator license in Las Vegas. I also specialize in the San Francisco, Oakland, Bay Area as our mortgage company is licensed in California, Nevada, and most states. In addition to helping hundreds of military veterans, retirees, business professionals, & medical professionals with their homeownership goals, I also have a background in healthcare and a masters degree in business administration. Outside of my passion for coaching, I recognize my mission in life is to help others and I absolutely enjoy seeing you reach your homeownership goals.

Areas Of Expertise

When we work together, I focus on two things primarily: To help you get the results you want, and to help solve the problems you have. I do this by educating you on the following topics:

- Mitigating rising interest rates - principal payment buydown & calculating money saved.

- What items can be depreciated & how it works.

- Mortgage interest tax write-offs & limits.

- Using home as a line of credit, for retirement, or a reverse mortgage

- Ability to complete mortgage in office or remotely/ digitally.

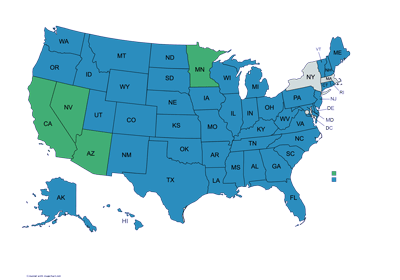

I am able to complete mortgage loans within our network in either green or blue states. The only states I am unable to originate mortgages in are New York and Washington D.C.

A Home Loan For Your Needs:

Homeownership Dreams Become Your Reality

A mortgage is certainly accessible for many hopeful home buyers and allows you to own a house. Furthermore, buying a home is certainly a lifelong dream for many people and is very realistic with the correct knowledge. Above all, we understand the importance of choosing the right lenders to complete your mortgage. We are here to turn your dreams into reality and make it a smooth process.

Furthermore, with more than 26 years of experience on our team, we take our professional oaths seriously. We back that up by getting mortgage loan approvals that are denied by other lenders in many cases. As a result, you will be confident with the knowledge that we only move forward when a particular home loan is in our client’s best interest. If you’re a first-time buyer looking for guidance, or already own a home and want to purchase another, we are certainly here for you. Whether you want to talk about your long term goals or the daily mortgage interest rates…

Give me a call & let’s help you.

The Financial Difference Between Renting and Buying

Pick the right choice for your circumstances

2022 is here and more & more people are stuck on the million-dollar question – Buying Vs. Renting. Consequently, anyone with a home loan approval can certainly be lured into buying a house, while it may not be in your best interest. Therefore, it is crucial to ask yourself the right questions when making a big decision. Certainly, the most critical question is – Is the time suitable for buying a home, what are the down payment requirements, and is it in your best interest?

Above all, ensure that you have the latest statistics on hand and not old, irrelevant information. As a result, you’ll certainly have a better opportunity to make the right decision with all the information that you need. You’ll definitely want to read and take notes from the article below by ManageCasa.

Credit, Income, & Assets

The mortgage process involves analyzing your credit, income, and assets to determine whether you are likely to receive a qualification for a mortgage. My pre-qualification process includes an AUS underwritten result so realtors know that your offer is certainly legitimate and the house is yours when you get your offer accepted. You’ll certainly benefit getting this part done ASAP while starting to look for houses. As a result, you’ll gain a clear idea of what you and your family qualify for, in addition to knowing how to put yourself in the best position possible.

Digital Mortgage App

Mortgages with a fast and straightforward process.

Secure Application Process:

100% Secure, 256-bit encryption

Easy to Complete

The Fastest Way to Get Started

Find the Loan that Works for you:

Low Monthly Payment

Low Interest Rates

Purchase or Refinance

What is Digital Mortgage?

Save time with our fast, easy process

Firstly, I understand applying for a mortgage is intimidating for many people. Therefore, I am here to make obtaining a home loan as seamless as possible while providing top notch service. Our digital mortgage loan application certainly provides an easy and secure application process that you complete at your own pace. Start by completing an easy-to-fill application by clicking apply now at the top and get in the game as soon as you’re ready.

Home Loan For Your Needs

Home loans have several different programs that vary for everyone, based on your finances & credit status. As a result, we are here guiding you in finding the mortgage rate and program that works for you. Therefore, we offer the following loan programs:

- Purchase or refinance

- Low monthly payment

- Low-interest rate

- Understand the digital mortgage system

Secondly, utilizing the digital mortgage process means that all mortgage documents are addressed without using paper, or coming into the office several times. As a result, the mortgage is produced, transferred, and securely stored without using paper. Therefore, your application is processed digitally. Additionally, a digital mortgage makes it possible to get a mortgage approval in a more timely manner..

Are You a Homeowner Looking to Refinance?

A new mortgage is not limited to first-time buyers. People looking to refinance can certainly take advantage by securing an approved mortgage. Take a look at refinancing opportunities and put your equity to good use. Additionally, refinancing to get a lower interest rate/mortgage rate or to seek the elimination of your mortgage insurance is available.

First Time Buyers

Buying a home for the first time is certainly a scary experience on its own. Therefore, it serves you well to have a basic mortgage knowledge so that you understand all that is required. The most critical and underrated tip is never to skip the house inspection.

Before you go any further, be sure to read about the do’s and dont’s, as well as home buying tips as a first time home buyer.

Home Inspection: Why you should always get an inspection... ALWAYS

Mortgage Calculators

Disclaimer

Information and interactive calculators are self-help tools for your independent use and are certainly not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. Furthermore, we encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Why is it critical to secure a mortgage first?

First, we don’t want to waste your time and money, while other banks may try to lead you on. A mortgage loan is offered by a variety of lenders and banks- public banks and private banks. Moreover, mortgage rates today continue to vary and are different for each borrower’s financial situation. They depend upon a variety of reasons that include your credit score, monthly income, and your assets. Lastly, we as lenders take a detailed look and guide you through the process of getting an approval for your mortgage. As a result, I can tell you if you will or will not qualify for a mortgage in our first conversation.

Mortgage Advisor Approach

First, we don’t want to waste your time and money, while other banks may try to lead you on. A mortgage loan is offered by a variety of lenders and banks- public banks and private banks. Moreover, mortgage rates today continue to vary and are different for each borrower’s financial situation. They depend upon a variety of reasons that include your credit score, monthly income, and your assets. Lastly, we as lenders take a detailed look and guide you through the process of getting approved for your mortgage. As a result, I can tell you if you will or will not qualify for a mortgage in our first conversation. And if you don’t currently qualify, what needs to be done in order to qualify.

A mortgage is a loan that you can use to buy a property or land. Mortgage rates today are certainly different than that of yesterday. Lenders take into account a variety of factors before going to a bank to obtain a mortgage rate for any property. Furthermore, lenders also inquire about your existing responsibilities and ask you to prepare the most recent 2 years of taxes, the most recent 2 years of W2’s, the 2 most recent months of bank statements, and your ID.

Lenders inquire about the following:

- The type of mortgage you want

- The kind of property you want to buy

- Amount of loan

- The borrowing period

- Kind of interest and mortgage rate

Take mortgage rates today into account when you decide about your mortgage home loan program. You are able to make informed decisions while knowing mortgage rates, your credit score, and payment capacity. A secured and approved mortgage places your purchase offer ahead of another buyer that doesn’t have an underwritten pre-qualification. Homeowners and sellers typically favor people with a pre-qualified mortgage loan. In addition, you are crystal clear about the kind of house you can buy with your mortgage.

Kickstart Your Mortgage Qualification Today.

Answer a few questions (3 Minutes) to see what your mortgage qualification could be. Get started now – no commitment necessary.